Most nonprofit professionals, whether you’ve just started or have been in the nonprofit sector for a long time, are familiar with form 990. This end-of-year tax form can be quite daunting, even for seasoned professionals, but especially if you’ve only just become acquainted with it. Form 990s are very important for ensuring that your nonprofit maintains its tax exempt status and is legally recognized as a 501(c)(3) nonprofit. While it can be complicated to know which version of the form is the right one for your organization and how to fill it out, this doesn’t mean you shouldn’t be able to complete it on time. In this guide, we’ll start from the beginning to make sure everyone is on the same page about what the Form 990 is and why it’s important. Then, we’ll dive into deadlines, strategies you can use to ensure you meet deadlines, consequences if you miss deadlines, and next steps for your nonprofit. We’ll cover all of this important tax-season information by answering the following questions:

- What is Form 990?

- What are the different versions of Form 990?

- How do I make sure I file on time?

- What happens if I miss the deadline?

- What should I do next?

Tax forms are an annual occurrence. Taking the time to better understand the process of filing them and strategies to do so on time will not only help you now but also for years into the future. Let's get started.

What is Form 990?

The Form 990 is the annual tax form that exempt organizations file to maintain their exemption status and report their earnings to the IRS annually. Most nonprofits have filed their 1023 to become a registered 501(c)(3) organization. Your 990 is necessary to file each year after you’ve filed the 1023 to maintain this important status as a registered nonprofit. Because you’re a nonprofit, the government allows you to reinvest the money that would have gone to pay taxes back into your mission. The IRS uses Form 990 as a way to ensure organizations aren’t taking advantage of the system and skipping out on taxes when they don’t deserve to. It’s the government’s way of checking that you’re using your money for what you say you are.

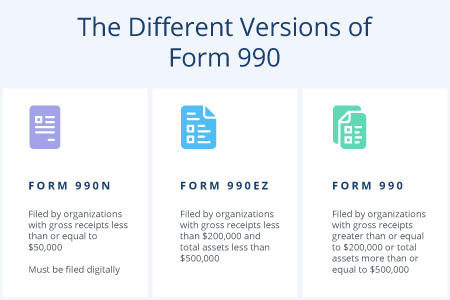

What are the different versions of form 990?

There are several different versions of Form 990, used by different sizes of organizations. The first step to ensuring your organization is set up this tax season this year is to determine the version of the form that your nonprofit should file.

Form 990-N

This form can be filed by organizations with gross receipts less than or equal to $50,000. This is also known as the e-postcard because it is the simplest of all of the form 990’s to submit. It’s a short 8-question form that must be completed entirely online. You’ll need to have the following to file this form:

- Your employer identification number (EIN)

- The tax year (calendar or fiscal filer)

- A legal name and mailing address

- Any other names the organization uses

- The name and address of a principal officer

- Your website address

- Confirmation that the organization's annual gross receipts are $50,000 or less

There are some organizations that are not eligible for this form even if they make less than $50,000. You can ensure your eligibility with the regulations listed on the IRS website.

Form 990-EZ

The next tier is Form 990-EZ, which is filed by organizations with gross receipts less than $200,000 or total assets totaling less than $500,000. It will require the following information in addition to the basics you would find on the form 990-N:

- Your mission

- Significant activities you’ve completed

- Revenues

- Expenses

- Assets

- Liabilities

- A list of your contributors

- More details regarding your financial statements

- Activities that occur outside of the country

- Your organization’s fundraising activities

This four-page form is considerably more in-depth than Form 990-N. However, it’s still a shorter form than the standard Form 990. Even so, it’s important to ensure that you have the necessary time to complete it properly if your organization is eligible to file this form.

Form 990

The full form 990 is typically filed by organizations with gross receipts greater than or equal to $200,000 or total assets more than or equal to $500,000. This form goes more in-depth than the 990-EZ but is similar in requiring more substantial evidence of all financial activity. Don’t forget that on these forms, you might need to file additional schedules depending on what you file in the core form itself. Besides these forms, which you can learn more about in File990’s guide to Form 990-N and 990-EZ, there is also form 990-PF which is specifically for private foundations and charitable trusts.

How do I make sure I file on time?

The deadline for filing is the 15th day of the 5th month after the month that concludes your fiscal tax year. For nonprofits that use the calendar fiscal year, this is May 15th. With this in mind, you should be sure to keep your financial information organized and tidy year-round to ensure a quick and easy process come tax season. In addition to ensuring clean financial data year-round, your nonprofit can also leverage specific software for tax season. Dedicated Form 990 softwarecan be a big help in ensuring that all of your information is correct and that you file on time. This is because effective software can:

- Send email reminders before your tax deadline, reminding the appropriate people at your organization that it’s time to file your annual forms again.

- Automatically pull consistent data from past years to make the filing process easier. For instance, it can use your EIN to pull information like your organization’s official name and mission directly from the IRS database.

Whether or not you have software to remind you to file, it’s crucial to keep meticulous records of all of your financial transactions. From major donations to monthly gifts, every donation should be recorded in your accounting solution. Likewise, all of your expenses should be very clearly recorded. A well-documented statement of functional expense can help you define all of the important allocations for your Form 990 because it’s already divided into the same categories as your tax form: programs, general management, and fundraising. Don’t forget that if you expect to be late for some reason, you can always file a form 8868. This form will extend your filing deadline for an additional six months.

What happens if I miss the deadline?

For organizations with receipts less than $1,000,000 per year, the penalty is $20 for every day you’re late. The maximum penalty is $10,000 or 5% of your gross receipts. If your receipts are greater than $1,000,000 per year, your penalty increases to $100 each day with a maximum charge of $50,000. You also put yourself at risk of losing your tax-exempt status entirely if you fail to file for more than three consecutive years. If this happens, you’ll need to reapply and pay filing fees.

What should I do next?

If you did miss your deadline for any reason, there are a few immediate steps you should take to protect yourself from further penalties. You may not be able to avoid paying any penalty fees, but you can at least avoid incurring any additional fees.

- Explain why you missed the deadline. If you have a reason, there’s a chance that the IRS will waive your late fees. It’s not a guarantee but it is worth a shot.

- Submit a correct form. It may take some time for the IRS to get back to you about waiving your fees so it’s best to go ahead and get a corrected form submitted.

- Avoid repeating this mistake. Identify the reason you were late, whether it was due to a lack of organization, missing financial information, misunderstanding the form, or any other reason. Then, make sure to take steps to protect yourself from falling into the same hole next year.

Sometimes, life gets in the way and you can’t help but miss a deadline. The best thing to do in situations like this is to rectify the mistake as quickly as possible and reassess your process to ensure that you don’t repeat the same mistake next year!

Form 990 is a necessity for all nonprofits who want to maintain their tax-exempt status and avoid paying fees, which is why it’s so important for you to understand it well. With our guide, you should now understand which form is best for you and how to properly file to avoid any late penalties. Properly filing your taxes doesn’t have to be a daunting process — you can do this! Good luck!